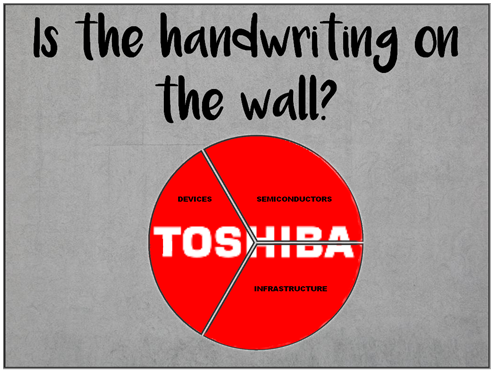

Driven by a major governance scandal and extreme pressure from activist investors who threatened a hostile takeover, Toshiba has approved a plan to split the company into three separate public companies to maximize the firm's value by dividing its businesses.

Over the next two years, the company will split off two core businesses, the energy and infrastructure business and the device and storage business, while retaining its core semiconductor business.

According to the company…

Toshiba Corporation announced a bold and ambitious plan to separate into three standalone companies to create enhanced value for our shareholders. This Plan is the culmination of nearly five months of work by the Strategic Review Committee of Toshiba’s board of directors to:

•Undertake a rigorously objective review process;

•Consider a full range of options to unlock shareholder value;

•Take into consideration the direct input of our shareholders and potential investors, both strategicand financial; and

•Develop the best approach for the Company to optimize value for shareholders and otherimportant stakeholders.

For Toshiba, its shareholders, employees and customers, the Separation Plan also represents a significant inflection point in its evolution – a new initiative that capitalizes on the government’s recent actions and looks beyond the confines of past Japanese business practices. It utilizes a tax-qualified spin-off structure permitted under recent legislation and represents a first for a major Japanese company of such size and importance. This approach reflects Toshiba’s determination to follow a course that will enhance long-term value for shareholders and it advances the intent of the recent legislation to further open up and revitalize Japan’s economy.

The implication for employees is unclear as each division will seek to maximize value by eliminating underperforming segments, burdensome layers of management, and seek expansion opportunities.